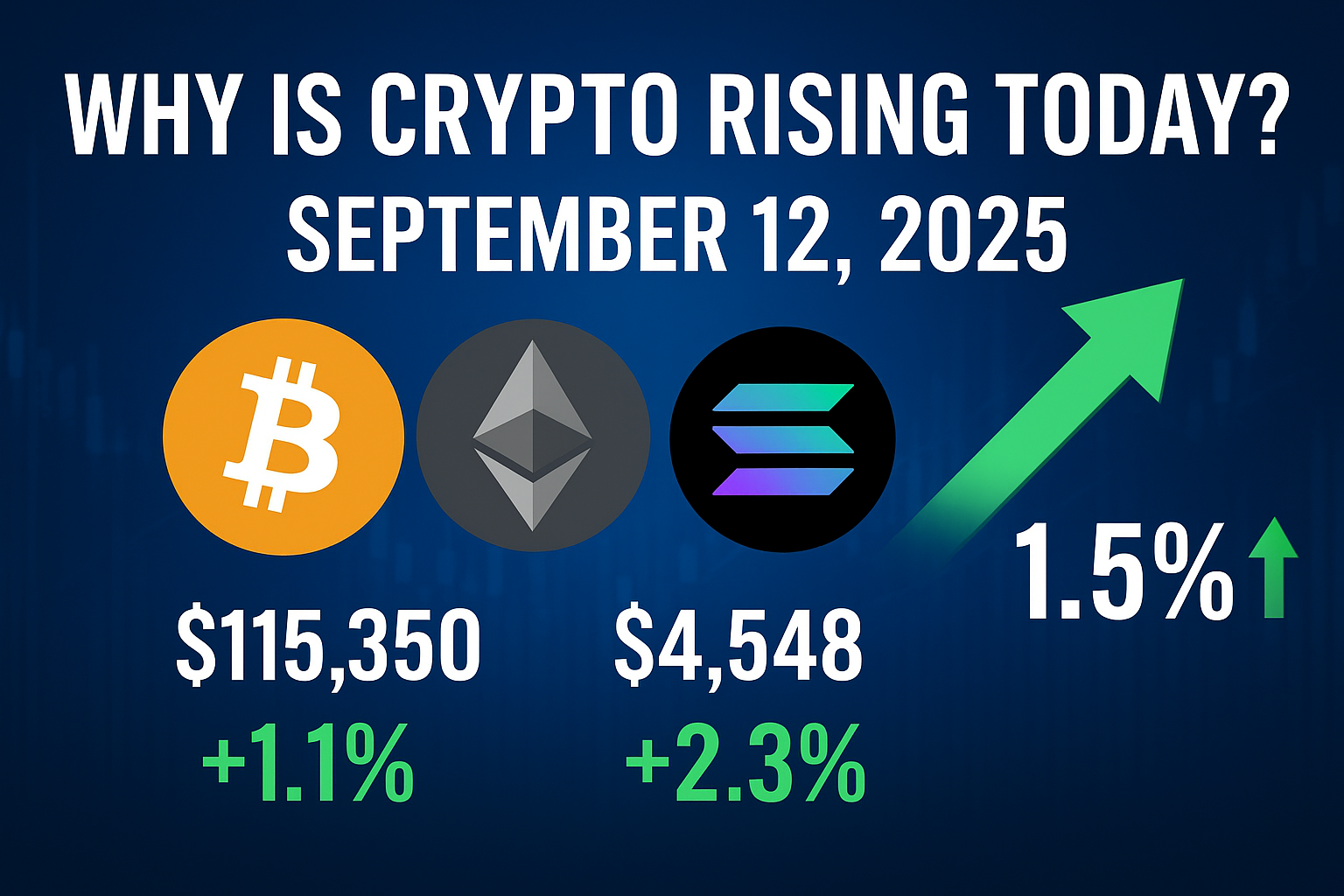

The global cryptocurrency market is back in the green, with total market capitalization climbing 1.5% to $4.12 trillion. Trading volume surged to $168 billion in the past 24 hours, and 92 of the top 100 cryptocurrencies are trading higher.

This rally comes as institutional flows, ETF demand, and investor sentiment continue to strengthen.

📊 Market Overview

📈 Why Is Crypto Rising? Understanding the Current Market Trends

- Global crypto market cap: $4.12T (+1.5%)

- Daily trading volume: $168B

- 92 of the top 100 tokens are in profit

- Bitcoin (BTC) trades at $115,350 (+1.1%)

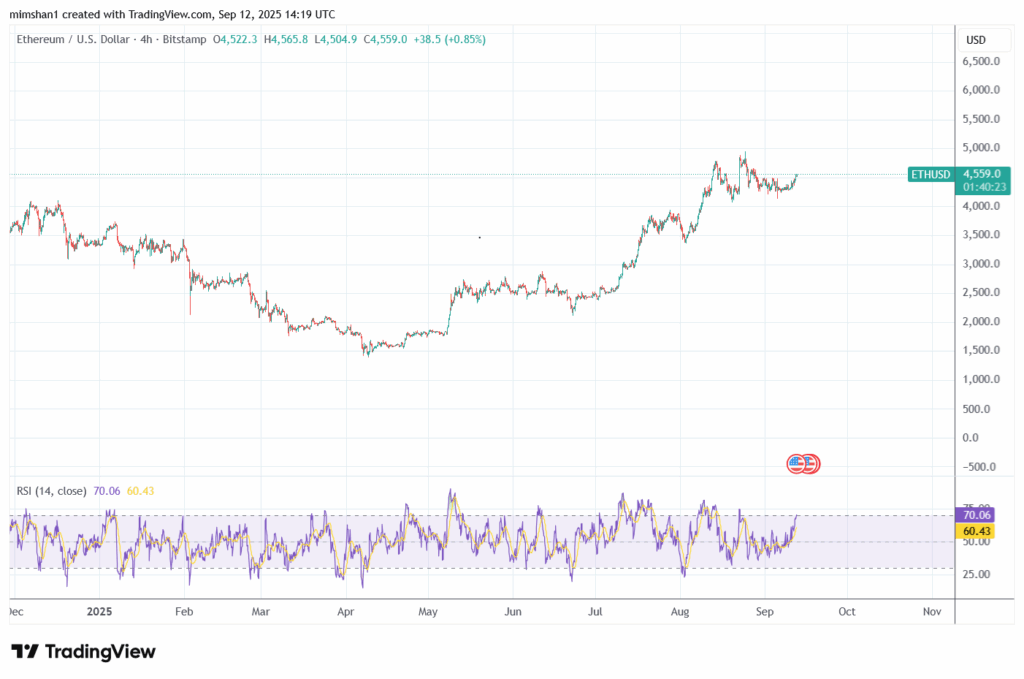

- Ethereum (ETH) hits $4,548 (+2.3%)

- Solana (SOL) leads majors with +7.1% at $238

- Fear & Greed Index rises to 50, signaling improving sentiment

🪙 Top Gainers and Losers

- Solana (SOL): +7.1% → $238

- Dogecoin (DOGE): +4.8% → $0.26

- Provenance Blockchain (HASH): +29.9% → $0.04

- Pudgy Penguins (PENGU): +9.6% → $0.037

On the downside:

- MYX Finance (MYX): –10% → $15.35

- Worldcoin (WLD): –2.8% → $1.71

📊 [Insert Chart: Daily Gainers & Losers]

📌 Key Drivers Behind the Rally

1. ETF Inflows Fueling Demand

- Bitcoin ETFs: $552.78M net inflows (BlackRock: $366.2M, Fidelity: $134.7M)

- Ethereum ETFs: $113.12M net inflows (Fidelity leads with $88.3M inflow)

📉 [Insert Chart: BTC & ETH ETF Flows]

2. Institutional Moves

- Galaxy Digital reportedly acquired 2.31M SOL (~$536M).

- FTX & Alameda reclaimed 192K SOL (~$44.9M).

These moves show big money shifting focus back to Bitcoin and Solana.

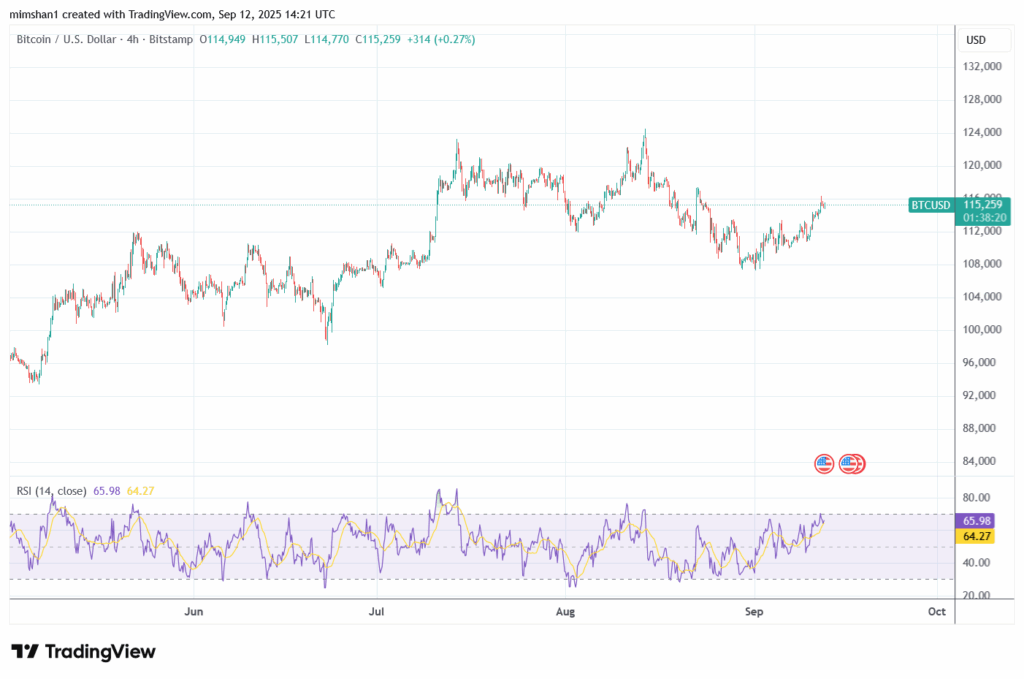

3. Volatility Compression

Nick Forster, founder of Derive.xyz, notes that options markets show compressed pricing:

“This is a classic sign of volatility contraction. Historically, these periods don’t last long — once volume returns, moves are sharp.”

📊 [Insert Chart: BTC Volatility Index]

🔮 What’s Next for BTC & ETH?

- Bitcoin (BTC):

- Support: $113K

- Resistance: $117.1K → $118.6K

- Probability of $125K by October rises from 40% → 52%

- Ethereum (ETH):

- Current: $4,548

- ATH: $4,946 (only 8.4% away)

- Probability of $6K by October drops from 23% → 19%

💡 Investor Sentiment

The Fear & Greed Index moved up from 47 → 50, showing a slow but steady shift toward optimism. Traders remain cautious, but the recent correlation with U.S. stock markets and ETF inflows suggest momentum could build further.

📊 [Insert Chart: Fear & Greed Index]

📝 Conclusion

The crypto rally on September 12, 2025 is being driven by ETF inflows, strong institutional activity, and narrowing volatility. While short-term consolidation is possible, the broader outlook remains bullish, especially for Bitcoin and Solana.

👉 With BTC only 7% below its all-time high and ETH eyeing $5K, markets could be setting up for another breakout in the coming weeks.