Crypto arbitrage has become one of the most talked-about strategies in the digital asset space. At its core, it involves exploiting price differences for the same cryptocurrency across different exchanges. While it sounds straightforward, executing arbitrage successfully requires speed, capital, and a strong understanding of both technical analysis and on-chain market dynamics.

- What Is Crypto Arbitrage?

- Types of Crypto Arbitrage Strategies

- Cross-Exchange Arbitrage

- Spatial Arbitrage

- Triangular Arbitrage

- Statistical Arbitrage

- DeFi Arbitrage (On-Chain)

- On-Chain Analysis of Arbitrage

- Technical Analysis for Arbitrage Trading

- How to Start Arbitrage Trading

- Risks of Crypto Arbitrage

- Why Arbitrage Still Matters

- Conclusion

What Is Crypto Arbitrage?

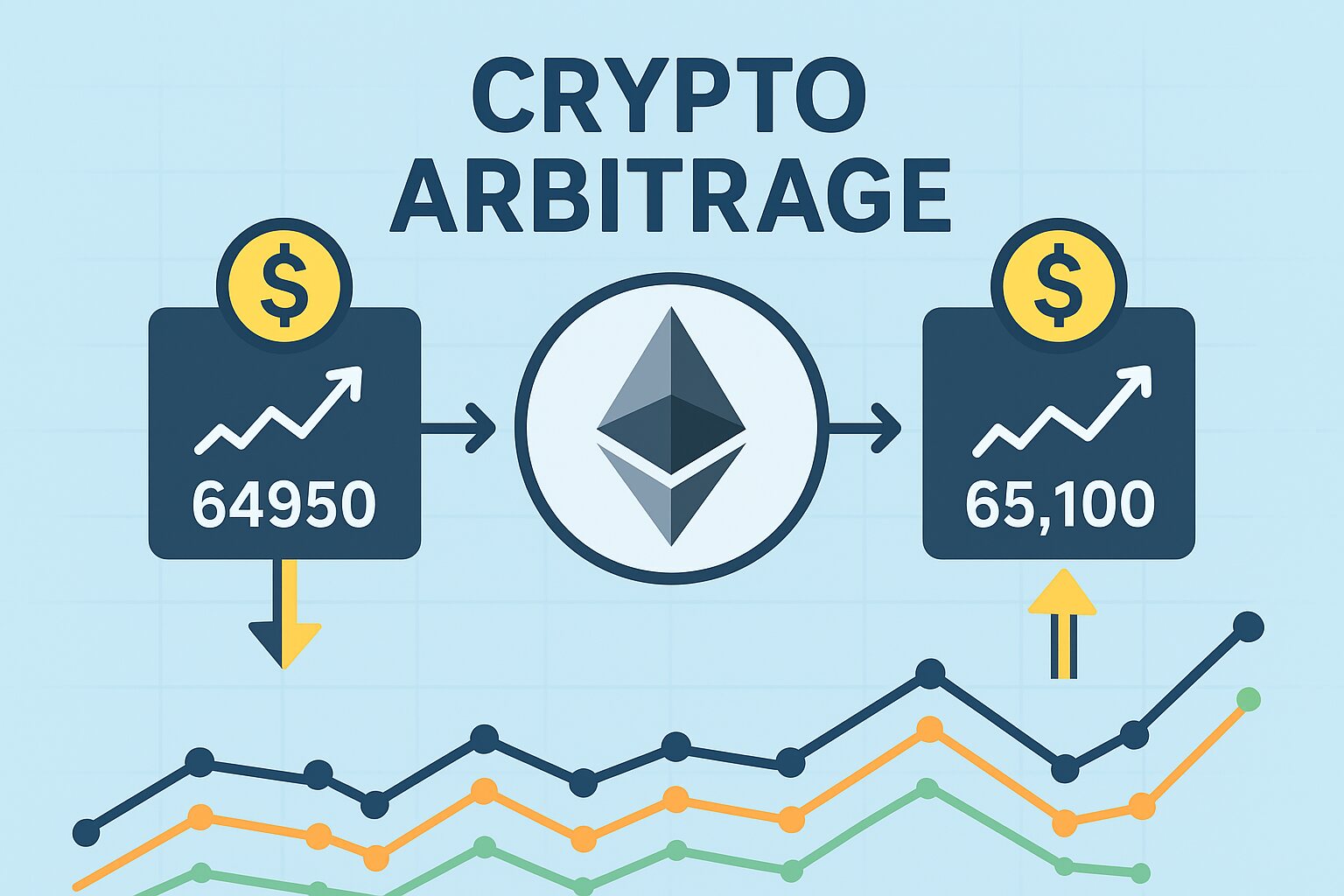

Arbitrage is the practice of buying an asset on one exchange at a lower price and selling it on another exchange where the price is higher. The goal is to capture the spread between these two prices.

- Example: If Bitcoin trades at $64,950 on Binance and $65,100 on Coinbase, a trader can buy 1 BTC on Binance and sell it on Coinbase for a $150 profit (excluding fees).

Types of Crypto Arbitrage Strategies

There are multiple forms of arbitrage in crypto markets. Each strategy has unique requirements and risks.

Cross-Exchange Arbitrage

The most common form of crypto arbitrage trading. It involves:

- Buying an asset on one exchange.

- Transferring or simultaneously selling it on another exchange.

Pros: Simple to understand, high liquidity.

Cons: Slow transfer times, withdrawal fees, slippage.

Spatial Arbitrage

A sub-type of cross-exchange where arbitrage occurs between regional exchanges. For example:

- Buying ETH cheaply on a South Korean exchange.

- Selling at a higher price on a U.S. exchange.

This is often referred to as the “Kimchi Premium” in South Korea.

Triangular Arbitrage

This strategy exploits inefficiencies within one exchange:

- Trade BTC → ETH.

- ETH → USDT.

- USDT → BTC.

If the cycle ends with more BTC than you started, the arbitrage is profitable.

Statistical Arbitrage

Uses quantitative models and algorithms. Often performed by trading bots that detect micro-price discrepancies across multiple markets.

DeFi Arbitrage (On-Chain)

In decentralized finance (DeFi), arbitrage is performed across DEXs (decentralized exchanges) using smart contracts.

- Example: Buying a token on Uniswap and selling on Sushiswap.

- Often executed using flash loans, enabling traders to borrow large amounts instantly, perform the arbitrage, and repay in the same transaction.

On-Chain Analysis of Arbitrage

On-chain data can help traders spot inefficiencies. Some useful metrics:

- Exchange inflows/outflows: High inflows may depress local prices.

- Liquidity pool depth: Shallow pools = higher arbitrage opportunities.

- Gas fees on Ethereum: High gas may kill profits from small arbitrages.

- Stablecoin movement: Large USDT/USDC transfers often precede arbitrage trades.

Table — Key On-Chain Signals for Arbitrage Opportunities

| On-Chain Metric | Why It Matters | Arbitrage Impact |

|---|---|---|

| Exchange Inflow | More tokens available on one exchange | Downward pressure → buy signal |

| Exchange Outflow | Reduced liquidity on one exchange | Upward pressure → sell signal |

| Gas Price | Cost of execution | High gas eats profit |

| Liquidity Depth | Determines slippage | Low depth = bigger arbitrage |

Technical Analysis for Arbitrage Trading

While arbitrage is less about long-term trends and more about short-term inefficiencies, technical indicators can still help:

- Order book depth: Shows where price gaps may form.

- VWAP (Volume Weighted Average Price): Helps spot deviations.

- Bollinger Bands: Wide bands often signal high volatility and temporary inefficiencies.

How to Start Arbitrage Trading

Tools Needed

- Multiple exchange accounts (Binance, Coinbase, Kraken, KuCoin, etc.)

- Arbitrage scanners like Coingapp, CryptoHopper, or Bitsgap.

- Fast execution bots for automated strategies.

Steps

- Monitor price differences with a scanner.

- Check fees (trading + withdrawal).

- Execute the buy and sell quickly.

- Track PnL (Profit and Loss).

Risks of Crypto Arbitrage

- Fees: Trading, withdrawal, and network fees can eat profits.

- Slippage: Prices can change while you execute.

- Transfer delays: Blockchain congestion may destroy profitability.

- Regulation: Some countries limit cross-border transfers.

- Competition: Bots dominate many arbitrage opportunities.

Why Arbitrage Still Matters

Despite high competition, arbitrage plays a crucial role in the market:

- It keeps prices across exchanges more aligned.

- It highlights inefficiencies in both centralized and decentralized markets.

- It allows institutions and retail traders to capture risk-adjusted returns.

Conclusion

Crypto arbitrage remains one of the few trading strategies that can generate market-neutral profits. However, it requires speed, capital, automation, and deep knowledge of on-chain dynamics. While profits exist, the market is highly competitive, and fees often reduce margins.

Not financial advice.