The crypto market has entered a critical stage as Bitcoin consolidates in the $115K–$125K zone. On-chain data shows whales unloading massive amounts of BTC, ETF inflows slowing, and retail traders stuck underwater. The big question: is this distribution or accumulation?

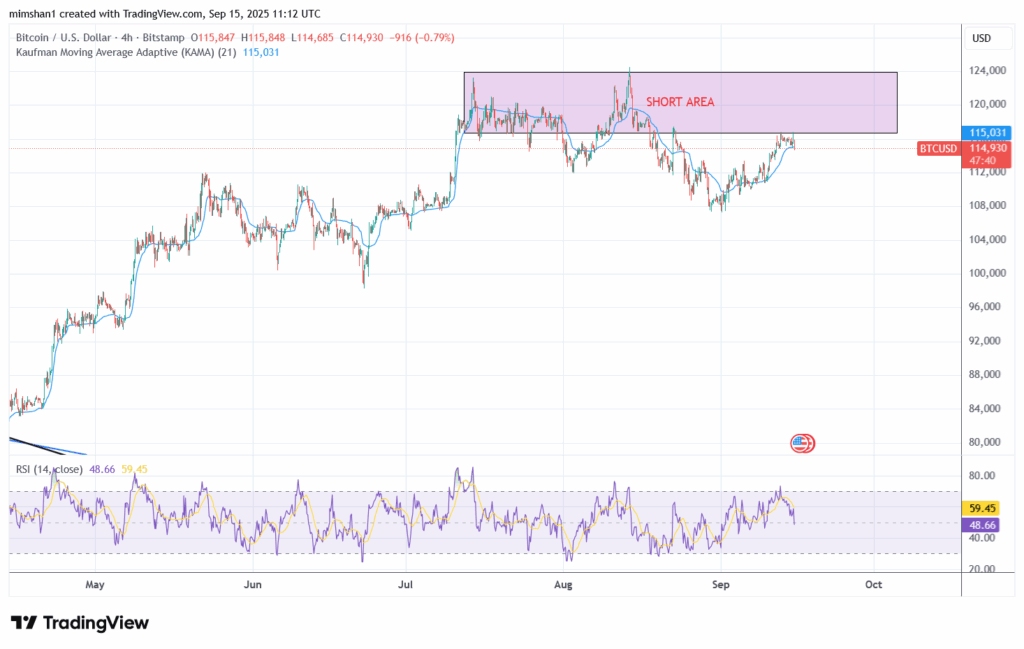

Whale Distribution in the $115K–$125K Zone

Recent on-chain data confirms wallets holding 1,000–10,000 BTC sold around 116,000 BTC in the last 30 days, worth nearly $13B. This marks the largest whale sell-off since July 2022.

- Whales use sideways chop to distribute gradually without triggering panic.

- Market makers unload in the $115K–$125K zone, hiding footprints on charts.

- Without strong new inflows, demand cannot absorb this selling pressure.

This sideways action matches the Wyckoff distribution phase, where whales offload supply to retail.

Retail Traders Still Underwater

Most retail longs and spot entries are between $117K–$122K over the past 3 months. Many remain in mild loss but haven’t capitulated yet.

- Small panic sells occurred near $107K in early September, but not a major shakeout.

- This leaves a dangerous setup: retail holds, whales sell, and once support breaks, cascading liquidations are likely.

Are Altcoins a Real Rally or Exit Liquidity?

While Bitcoin chops sideways, altcoins have pumped aggressively. The so-called “altcoin season” has sparked excitement, but evidence suggests a trap:

- Over 70% of alts are outperforming BTC temporarily.

- The strongest gainers are newly listed, exchange-driven tokens with no fundamentals.

- High leverage in alts makes them fragile.

History shows alt rallies during Bitcoin distribution often serve as exit liquidity for whales.

Technical & On-Chain Evidence

Accumulation/Distribution Indicator

The A/D line is falling despite stable price action → clear distribution pattern.

ETF Inflows and Market Liquidity

After strong July inflows, Bitcoin spot ETF demand has slowed to ~500 BTC/day. Without consistent inflows, whales dominate supply.

Whale Netflows to Exchanges

Exchange inflows spiked in late August → whales are actively sending coins to sell.

Key Strategic Takeaways

| Zone | Implication | Strategy |

|---|---|---|

| $115K–$125K | Heavy whale distribution | Take profits or hedge shorts |

| $110K–$106K | Weak support, liquidity zone | Risk of cascading sell-offs |

| $90K–$100K | Major liquidity pool | Potential long-term buy zone |

Final Market Outlook

The $115K–$125K range is not accumulation — it’s distribution. Whales are unloading into retail optimism, while altcoin pumps provide distraction.

Unless ETF inflows return strongly, BTC risks a correction below $110K, with liquidity extending down to $90K. Retail celebrating small bounces in this zone may be acting as exit liquidity.

⚠️ Not financial advice. Educational content only.