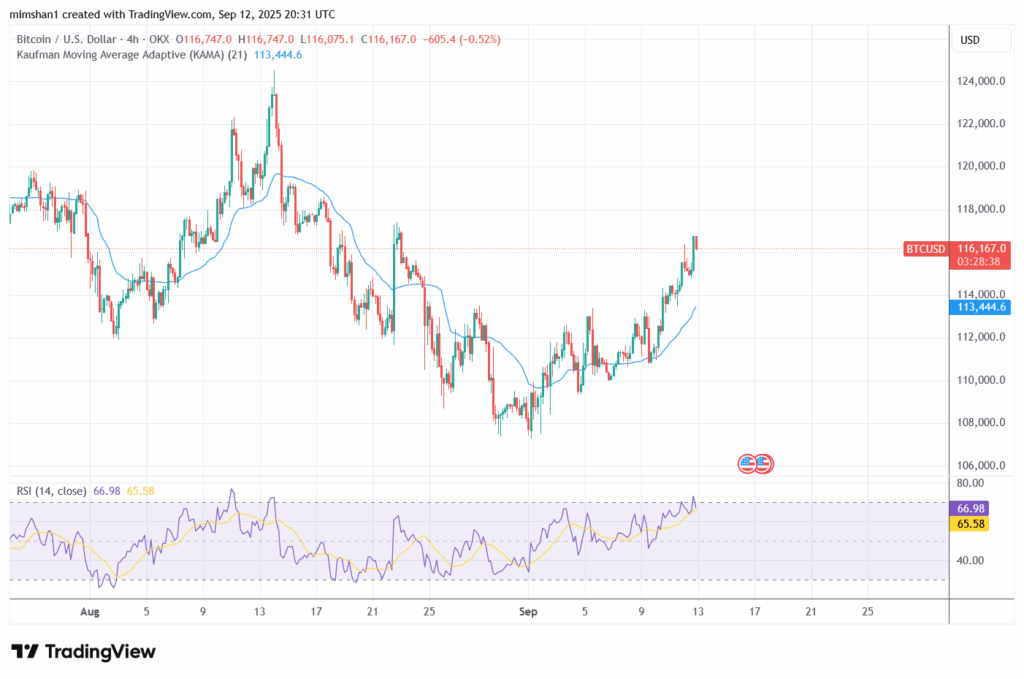

Bitcoin (BTC) surged past $116,000 on Friday as investors reacted to fresh US inflation and jobs data, boosting expectations that the Federal Reserve could soon cut interest rates.

The crypto market rallied, with Ethereum (ETH) gaining 2.5% to reach $4,519, while the total cryptocurrency market capitalization climbed 1.5% to $4.1 trillion.

US Inflation & Jobs Data Fuel Rate Cut Hopes

New data released on Thursday showed that the US Producer Price Index (PPI) unexpectedly fell 0.1%, compared to a forecasted 0.3% increase. Meanwhile, the Consumer Price Index (CPI) confirmed headline inflation was rising, but not at a pace strong enough to block monetary easing.

Adding to the dovish outlook, the US Bureau of Labor Statistics revised its 12-month jobs report downward, slashing employment figures by nearly half. This suggests the labor market is far weaker than previously thought.

Greg Magadini from Amberdata explained:

“Stable inflation and weaker job growth push the Fed to focus on supporting the economy. This increases the odds of a rate cut by 50 basis points, possibly as soon as next week or in October.”

Bitcoin’s Momentum Strengthens

As markets priced in rate cut expectations, risk assets from Bitcoin to gold saw strong inflows.

Gadi Chait, Investment Manager at Xapo Bank, noted that Bitcoin climbed to $114,000 earlier this week, showing resilience despite macroeconomic uncertainty:

“The divergence between inflation and weak employment creates almost ideal conditions for Bitcoin, as investors seek protection against currency depreciation and market volatility.”

Meanwhile, US weekly jobless claims spiked to 263,000, further fueling speculation of a Fed cut in September.

Institutional Demand Remains Strong

Institutional interest continues to grow. On September 11, spot Bitcoin ETFs recorded $553 million in net inflows, while Ethereum ETFs attracted $113 million.

This highlights how large investors are positioning ahead of the Fed’s next policy decision — a potential rate cut that could ignite the next stage of the crypto bull market.

Outlook

With the Fed’s policy meeting approaching, traders and institutions alike are watching closely. If the central bank cuts rates by 50 basis points, Bitcoin could extend its rally beyond $116,000, potentially setting new all-time highs before year-end.

📌 Key Takeaways

- Bitcoin briefly touched $116K amid Fed rate cut expectations.

- US inflation cooled, while jobs data weakened significantly.

- Ethereum hit $4,519, and total crypto market cap reached $4.1T.

- Spot Bitcoin ETFs saw $553M inflows, showing strong institutional demand.