Introduction

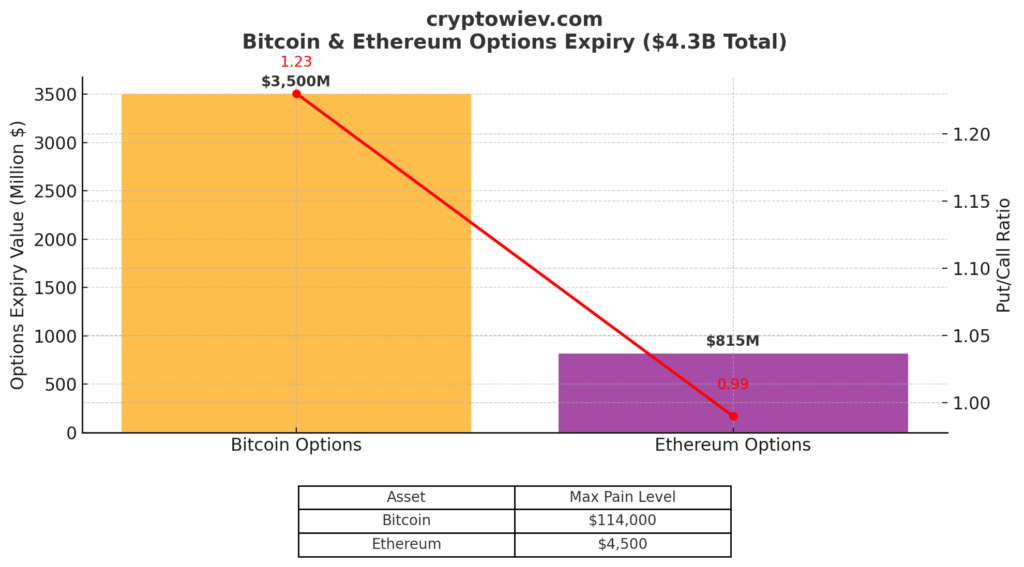

The crypto market faces heightened volatility as nearly $4.3 billion worth of Bitcoin and Ethereum options expire today. The scale of this expiry is significant, making it a critical moment for traders and investors alike. Both Bitcoin options expiry and Ethereum options expiry events often serve as catalysts for price swings, as derivative positions unwind and spot markets absorb the impact.

In this article, we analyze the technical setup, on-chain sentiment, and possible market outcomes surrounding this massive expiry.

Bitcoin Options Expiry: $3.5B in Play

Open Interest and Put-Call Ratio

Roughly $3.5 billion in Bitcoin options reach maturity today. Current data indicates a put-call ratio of 1.23, meaning there are slightly more bearish bets (puts) than bullish bets (calls). This suggests traders are hedging against potential downside risk in BTC.

Max Pain Level for Bitcoin

- Max pain price: $114,000

- This level represents the strike where the majority of options lose value, benefiting sellers.

- A gravitational pull toward this zone could add short-term pressure on Bitcoin.

Table 1: BTC Options Snapshot

| Metric | Value | Sentiment |

|---|---|---|

| Total Options Value | $3.5 Billion | High volatility |

| Put-Call Ratio | 1.23 | Bearish leaning |

| Max Pain Level | $114,000 | Neutral pressure |

Ethereum Options Expiry: $815M

Balanced Market Positioning

Ethereum options worth nearly $815 million are expiring today. The put-call ratio of 0.99 indicates near-perfect balance between bullish and bearish positions, signaling less directional conviction compared to Bitcoin.

Max Pain Level for Ethereum

- Max pain price: $4,500

- ETH could trend toward this settlement point.

- The balanced ratio suggests traders are split, which may lead to volatile intraday moves.

Table 2: ETH Options Snapshot

| Metric | Value | Sentiment |

|---|---|---|

| Total Options Value | $815 Million | Moderate impact |

| Put-Call Ratio | 0.99 | Balanced |

| Max Pain Level | $4,500 | Neutral pressure |

Why Options Expiry Matters for Crypto Volatility

Key reasons for market turbulence during options expiry:

- Hedging flows: Traders adjust spot and futures positions to offset risk.

- Liquidity shocks: Expiry events create sudden surges in trading volume.

- Psychological anchors: Max pain levels influence short-term sentiment.

On-Chain Analysis: BTC and ETH

Bitcoin On-Chain Data

- Exchange inflows show moderate increase, signaling traders may prepare to sell or hedge.

- Funding rates remain positive but slightly cooling, pointing to reduced leverage appetite.

- Whale movements indicate profit-taking around $116K.

Ethereum On-Chain Data

- Gas fees remain steady, showing no panic-driven activity.

- Staked ETH levels continue to climb, suggesting long-term confidence despite expiry risks.

- Derivatives open interest remains elevated, consistent with today’s expiry magnitude.