Introduction

The Bank of Japan ETF unwind has triggered a ripple effect across global markets, with equities, bonds, and cryptocurrencies feeling the pressure. As the central bank moves to reduce its massive ETF holdings, investors are closely watching how this historic policy shift will impact asset prices. Among the most notable reactions is in Bitcoin, which dipped from $118,000 to around $116,000 following the news. In this article, we will break down the reasons behind Japan’s move, the market consequences, and how Bitcoin and the broader crypto sector are positioned.

Understanding the Bank of Japan ETF Unwind

Why the Unwind Matters

The Bank of Japan (BOJ) is one of the few central banks that accumulated vast amounts of equities through Exchange-Traded Funds (ETFs) and Real Estate Investment Trusts (JREITs). This portfolio, valued at nearly $250 billion, is now set for gradual reduction. BOJ will sell $2.2 billion annually in ETF shares, though the market value approximates closer to $4.2 billion.

- Policy objective: Reduce market distortions from BOJ’s oversized role.

- Inflation concerns: August core CPI rose 2.7%, above the 2% target.

- Long horizon: At this pace, full liquidation could take centuries.

Timeline of Actions

| Event | Detail | Market Reaction |

|---|---|---|

| ETF sale plan | $2.2B annually | Equities fell sharply |

| JGB yields | 10Y bonds rose to 1.64% | Yen strengthened |

| Bitcoin dip | $118k → $116k | Crypto sold off with risk assets |

How the ETF Unwind Affects Global Markets

Equity and Bond Markets

- Nikkei index dropped by more than 1% after the BOJ announcement.

- Bond yields spiked as investors anticipated reduced central bank support.

- The BOJ kept its benchmark rate at 0.5%, but some policymakers hinted at possible tightening.

Impact on Risk Assets and Crypto

The unwinding of ETFs signals a withdrawal of liquidity, a core driver of risk asset rallies. Cryptocurrencies, often viewed as high-beta assets, reacted quickly to this shift.

- Bitcoin dropped ~2% in hours.

- Ethereum and major altcoins followed.

- On-chain data showed exchange inflows rising, indicating short-term selling pressure.

Bitcoin Technical and On-Chain Analysis

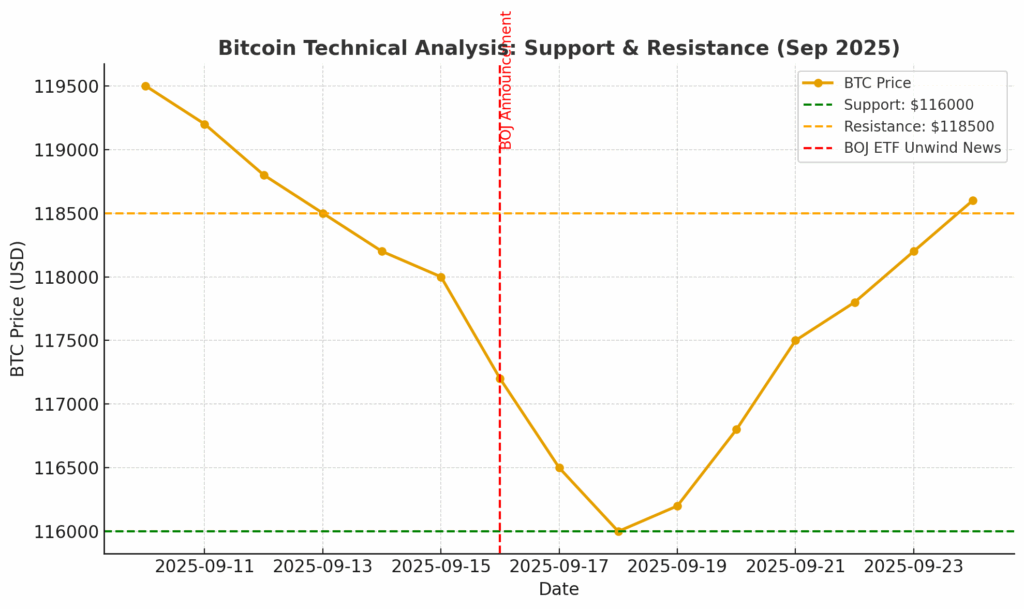

Bitcoin Price Chart Insights

Recent Bitcoin charts highlight important support and resistance levels:

- Support zones: $115,000 and $112,500.

- Resistance levels: $120,000 and $125,000.

Price action suggests that while short-term weakness is present, long-term uptrend structure remains intact.

On-Chain Signals

- Exchange inflows: Spiked after BOJ news, suggesting traders moving BTC to sell.

- Whale activity: Some large holders reduced positions around $118k.

- Funding rates: Neutral, showing derivatives markets remain cautious.

These signals point to short-term volatility but sustained long-term bullish fundamentals.

Bitcoin in the Context of Global Liquidity

Why Liquidity Matters for Bitcoin

Bitcoin’s performance is closely linked to global liquidity. When central banks add liquidity through asset purchases, Bitcoin often rallies. Conversely, liquidity withdrawal creates headwinds.

- BOJ ETF unwind = reduced liquidity

- Impact cascades into global markets

- Bitcoin reacts like other risk-on assets

Potential Scenarios

- Short-term bearish: If BOJ accelerates ETF sales, Bitcoin could retest $110k.

- Medium-term neutral: Gradual unwind may be absorbed if global liquidity remains strong.

- Long-term bullish: Bitcoin continues to benefit from its role as a hedge against fiat currency debasement.

Lessons from Previous Central Bank Moves

| Central Bank | Action | Market Impact |

|---|---|---|

| Federal Reserve (2013) | Tapering QE | Risk assets corrected |

| ECB (2018) | Reduced bond purchases | Equities softened |

| BOJ (2025) | ETF unwind | Equities, bonds, crypto dropped |

History shows that any reduction in central bank support leads to volatility. Bitcoin’s reaction fits this global pattern.

Conclusion

The Bank of Japan ETF unwind marks a historic shift in monetary policy. Its effects are already visible: weaker equities, higher bond yields, and a short-term Bitcoin dip. While the crypto market faces volatility, Bitcoin’s long-term fundamentals remain resilient, driven by adoption, scarcity, and global demand.

Investors should prepare for short-term turbulence but recognize that Bitcoin thrives in cycles of uncertainty and policy shifts.

Not financial advice. Always do your own research.