The AI investment boom of 2025 is staggering: global spending, corporate and startup funding, hardware infrastructure – everything is accelerating. But with so much money flowing in, some analysts are warning of an AI bubble risk: when expectations outpace actual productivity or returns, a sharp correction could cause serious economic stress. This article examines how much money is in AI, technical and on-chain signs, scenarios for a burst, and whether it could lead to a broader economic crisis.

- How Much Money is Flowing into AI?! (Global Scale & Recent Data)

- Technical & On-Chain / Empirical Indicators of Overvaluation

- Productivity vs Hype Gap

- Valuation Multiples & Investor Behavior

- Market Sentiment, Risk & Regulatory Pressure

- What Happens If the AI Bubble Bursts? Scenarios & Possible Economic Fallout

- What I Mean by “Bubble Burst”

- Short-Term Effects

- Mid- to Long-Term Effects & Economic Crisis Risk

- Could It Become a Broader Crisis?

- Cause-Effect Analysis

- Is It Likely / When Could It Happen?

- Conclusion

How Much Money is Flowing into AI?! (Global Scale & Recent Data)

Private & Corporate AI Spending

- In 2024, corporate AI investment globally was about US$252.3 billion, up significantly from prior years.

- Generative AI in particular raised US$33.9 billion in private investment in 2024, an ~18.7% increase vs. 2023.

- Big tech giants (Microsoft, Alphabet/Google, Amazon, Meta, etc.) plan to spend about US$320 billion in 2025 on AI technologies & infrastructure—up from ~US$230B in AI capital expenditures in 2024.

Market Size, Forecasts & Projections

- The global AI market (software, services, hardware) is currently valued around US$391 billion (2025) and is projected to reach US$1.81 trillion by 2030. Compound annual growth rate (CAGR) ~35.9%.

- In terms of startups: generative AI start-ups and others are receiving large funding rounds; for example Figure was valued at US$39B in its recent Series C after raising over US$1B.

- Also, hardware & infrastructure: data centres, inference chips are seeing massive investment. For instance, Groq recently raised US$750 million, pushing its valuation to US$6.9B.

Technical & On-Chain / Empirical Indicators of Overvaluation

These are signals that experts are watching to see if the hype is getting ahead of fundamentals.

Productivity vs Hype Gap

- Many companies adopting AI report usage, but measurable profit / productivity gains are often modest. According to the Stanford HAI 2025 report, many organizations using AI see cost savings or efficiency improvements, but rarely above ~10%.

- The Atlantic, in its analysis, notes that despite billions invested, “companies trying to incorporate AI have seen virtually no impact on their bottom line.”

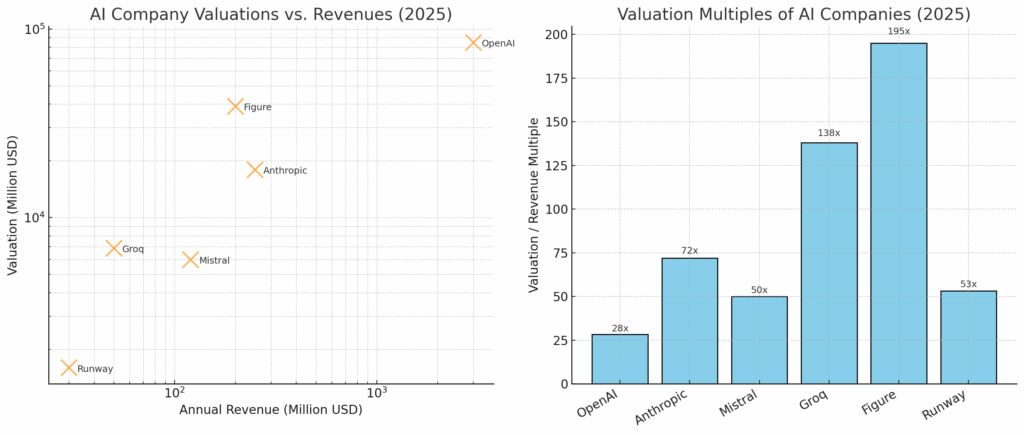

Valuation Multiples & Investor Behavior

- Valuations of AI companies are often far ahead of actual revenue, or even business models. Many start-ups are still in early phases, without steady cash flows.

- There is competition in hardware (GPUs, inference chips), infrastructure, data centers—areas which require huge capital expenditure and long-term returns. If demand or supply disrupts, costs could decline, but investors may suffer.

Market Sentiment, Risk & Regulatory Pressure

- Several analysts & media are asking: Is AI overhyped? Could be similar to past tech bubbles.

- Rising interest rates, macroeconomic pressure, supply chain constraints, regulatory oversight (privacy, safety, data use) could all cut into-margin or slow deployment.

What Happens If the AI Bubble Bursts? Scenarios & Possible Economic Fallout

What I Mean by “Bubble Burst”

A “bubble burst” here means: valuations sharply correcting, venture capital drying up, many AI startups failing; overbuilt infrastructure (data centres, chips) underutilized; investor losses; reduced optimism.

Short-Term Effects

| Domain | Possible Effects |

|---|---|

| Tech sector valuations | Plunge in market caps, failed IPOs, write-downs of startups. |

| Employment | Layoffs in AI R&D, startups; hiring freezes especially for speculative projects. |

| Investor losses | VCs, angels suffer; limited partners (pension funds, funds of funds) exposed. |

| Consumer trust | Overpromising and underdelivering may reduce adoption, slow further innovation. |

Mid- to Long-Term Effects & Economic Crisis Risk

- GDP growth slowdown: If AI investments contributed significantly to growth (via corporate capex), a reversal could shave off growth percentage points. Some sources suggest AI investment is propping up certain economies.

- Stock market correction: Big tech stocks could fall, which may cascade across indices, pensions, retirement funds.

- Credit and debt strain: Companies heavily leveraged to build infrastructure might struggle; losses could affect lenders.

- Labour market disruptions: If many workers were expecting AI to create jobs, but instead layoffs hit, could reduce consumer spending, increase unemployment claims.

Could It Become a Broader Crisis?

Yes — under certain conditions:

- If AI overinvestment is sharply reversed, it might lead to a credit crunch, especially for those companies whose debt is large.

- If macroeconomic conditions are weak, combined with geopolitical tensions, supply chain shocks, inflation etc., it could amplify negative feedback loops.

- Governments stepping in may face difficulties: stimulus may be required; regulation may restrict future funding flows; geopolitical competition (US-China) might exacerbate risk misallocation.

Cause-Effect Analysis

- Because huge sums are invested in AI infrastructure & startups → this creates high expectations for returns. If returns are slow, investor sentiment sours → rapid valuation declines.

- Because many AI firms are in early stage, with unproven business models → high risk of failure. If a large number of them fail, losses accumulate.

- Because the technology requires capital-intensive hardware (data centers, chips), which have long lead times and upfront cost → underutilization or oversupply can create wasted capacity and losses.

- Because public policy and regulation are playing catch-up → unexpected regulatory burdens or restrictions could reduce profitability or delay rollout, worsening mismatch between expectations and reality.

Is It Likely / When Could It Happen?

Leading Signals to Watch

- Slowdown in funding rounds / fewer late-stage raises.

- Declining margins or evidence that many AI projects do not scale.

- Overcapacity in hardware / data centers.

- Rising interest rates or credit tightening.

- Regulatory clampdowns (privacy laws, AI safety rules, export controls etc.).

Possible Timing

It might not be immediate. Maybe 1-3 years before serious correction if several factors align (economic slowdown, policy changes, market saturation).

Conclusion

AI investment in 2025 is massive: hundreds of billions of dollars from private and corporate sources, rising valuations, intense competition, and expanding infrastructure. But there is a real risk of an AI bubble: where hype outpaces proven returns. If that bubble bursts, we could see stock market corrections, startup failures, job losses, and broader impact on economic growth.

That said, AI also has fundamental potential: significant productivity gains, new business models, transformation in many sectors. Even if there is a correction, it won’t erase all progress — likely it will reshape the landscape, with winners and losers.

Not financial advice.