Hyperliquid’s native token HYPE is dominating the crypto headlines this week, posting a 23% rally and emerging as one of the market’s top performers. In a sector still shaking off volatility, HYPE’s bullish surge is being powered by three strong catalysts: the battle to issue its stablecoin USDH, growing whale and institutional accumulation, and speculation over a potential VanEck HYPE Spot Staking ETF.

The Battle for USDH: Paxos vs. Frax vs. Sky

A major storyline fueling HYPE’s price is the competition among issuers to launch USDH, Hyperliquid’s native stablecoin. Heavyweights including Paxos, Frax Finance, Sky, Agora, and Ethena Labs are all vying for the role.

- Paxos recently partnered with PayPal, sweetening its proposal with HYPE token listings, free USDH on/off-ramps, and a $20M ecosystem reward fund.

- Sky countered with a revenue-sharing model and a commitment to neutrality.

- Meanwhile, Ethena Labs has reportedly exited the race, narrowing the field.

This intense competition underscores the growing legitimacy and long-term potential of the Hyperliquid ecosystem, drawing more eyes — and capital — toward HYPE.

Whale Accumulation and Institutional Confidence in HYPE

Beyond the stablecoin narrative, HYPE is also benefitting from a wave of whale accumulation and institutional interest.

- BitGo added support for HyperEVM, enabling qualified clients to access compliant custody solutions.

- Lion Group Holding made headlines by reallocating $600 million from SOL and SUI into HYPE, citing Hyperliquid’s deep liquidity and efficient trading infrastructure.

Such moves signal growing institutional trust in HYPE, validating its role as a serious contender in the DeFi landscape.

HYPE ETF Rumors: VanEck in the Spotlight

Perhaps the most exciting development is the buzz around a potential VanEck HYPE Spot Staking ETF. Reports suggest that VanEck is preparing to file for approval in the U.S. while simultaneously planning a European-listed ETP.

If approved, this ETF would:

- Give institutions direct exposure to HYPE

- Use profits for HYPE buybacks, increasing demand

- Make HYPE the youngest token ever linked to an ETF filing

The rumors alone have boosted sentiment, with traders anticipating a fresh wave of institutional liquidity.

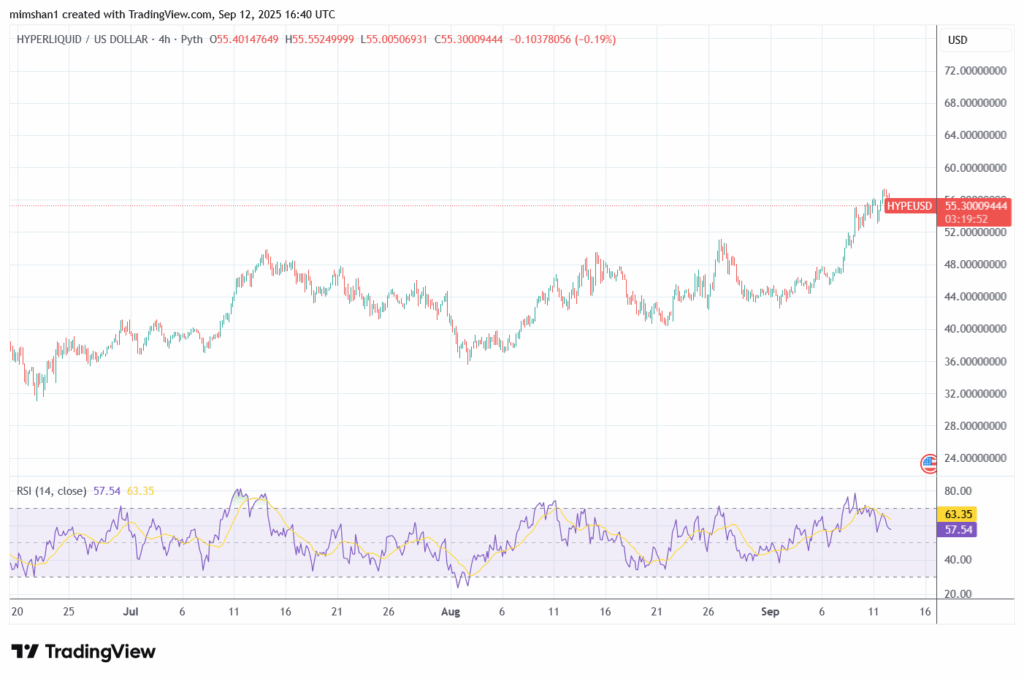

Technical Analysis: Where Next for HYPE Price?

As of press time, HYPE trades at $55.80, extending its rally from the $47.00 support zone.

- RSI: 67.64 — near overbought, signaling strong bullish momentum with possible short-term cooling.

- MACD: Bullish, with widening histogram bars confirming momentum.

- Support Levels: $52.00 and $47.00

- Resistance Levels: $58–$60 range, with a breakout paving the way toward $65–$70

While short-term profit-taking could create pullbacks, the fundamentals remain strong, and the growing institutional narrative is fueling optimism for further gains.

Conclusion

Hyperliquid’s HYPE token has captured the spotlight with its double-digit rally. From the battle over USDH issuance, to whale and institutional inflows, to ETF speculation, momentum around HYPE is intensifying.

With fundamentals strengthening and technical indicators still bullish, HYPE could remain one of the most-watched altcoins in the coming weeks.