Ethereum exchange-traded funds (ETFs) have faced six consecutive days of net outflows, totaling over $1.04 billion, as investors remain cautious amid ongoing macroeconomic uncertainty. The latest figures highlight diverging investor sentiment across institutional crypto products, with some funds recording steep withdrawals while others attracted new capital.

📉 BlackRock Leads Withdrawals, Fidelity Sees Inflows

- On Monday, Ethereum ETFs lost $96.7 million overall.

- BlackRock’s ETHA fund led the outflows with $192.7 million in redemptions.

- In contrast, Fidelity’s FETH ETF attracted $75 million in new inflows, showing that selective institutional appetite remains.

- Grayscale’s ETHE and its mini version recorded a combined $20.5 million in modest inflows.

Despite the outflows, total Ethereum ETF trading volume hit $1.52 billion, while net assets dropped to $27.39 billion, representing 5.28% of Ethereum’s total market capitalization.

📊 Largest and Smallest Daily Moves

The six-day stretch of outflows was marked by sharp contrasts:

- Friday: the largest single-day withdrawal at $446.7 million.

- Wednesday: the smallest daily outflow at $38.2 million.

These fluctuations reveal the growing sensitivity of crypto markets to macroeconomic signals and central bank policies.

🏦 Fed Policy Expectations and Market Reactions

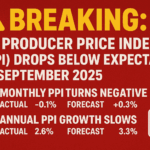

According to the CME FedWatch Tool, markets are pricing in a 100% probability of a Fed rate cut in September 2025. However, leading strategists warn that lower rates may not deliver the expected economic boost.

- JPMorgan’s David Kelly suggested that rate cuts could reduce business confidence and dampen retirement incomes, challenging traditional assumptions about monetary easing and its effect on risk assets like Ethereum ETFs.

- Broader markets are showing defensive positioning, with falling Treasury yields, a sideways US dollar, and rising gold prices.

💹 Ethereum Price Outlook

Ethereum is currently trading above the $4,250–$4,300 support zone, but faces resistance around $4,500. The combination of ETF outflows and macro pressures could determine whether ETH breaks higher or consolidates further.

🔄 Divergence Between Ethereum and Bitcoin ETFs

Interestingly, spot Bitcoin ETFs recorded $368.25 million in inflows on Monday, ending a two-day outflow streak. This divergence highlights how institutional investors are reallocating within crypto markets rather than exiting completely, adopting tactical allocation strategies based on asset-specific narratives.